Over the last five years displays have become an integral part of the cockpit experience. In this article we explore the growing diversity of display shapes, sizes and configurations, and analyze what it means to OEM strategies.

The proliferation of high-quality displays within the CE market has driven up consumer expectations for larger, more responsive and more functional displays in the car. Car makers have responded to this pressure in two ways:

Trend 1: Bigger displays

The race towards larger displays has ramped up over the last 4 years. The chart below shows the rapid decline of smaller display sizes in favor of larger ones. Premium brands in the USA have quickly phased out smaller 7”-8” displays within their flagship headunits, while ramping up 10”-17” displays. Mainstream brands in turn have quickly phased out 3”-6” displays, with the industry settling on 8” displays for their flagship headunits.

Although flagship headunits have continued to grow in size, most car makers continue to have a significant distribution in unit sales across various display sizes. The chart below highlights the penetration rates by display size for various brands across their entire vehicle line-up. This also helps to highlight the level of fragmentation, with some companies (Volvo, Lincoln, GM, Subaru and Nissan) relying on a much narrower set of display sizes compared to others (e.g. BMW, Mercedes-Benz, Audi, Dodge, RAM).

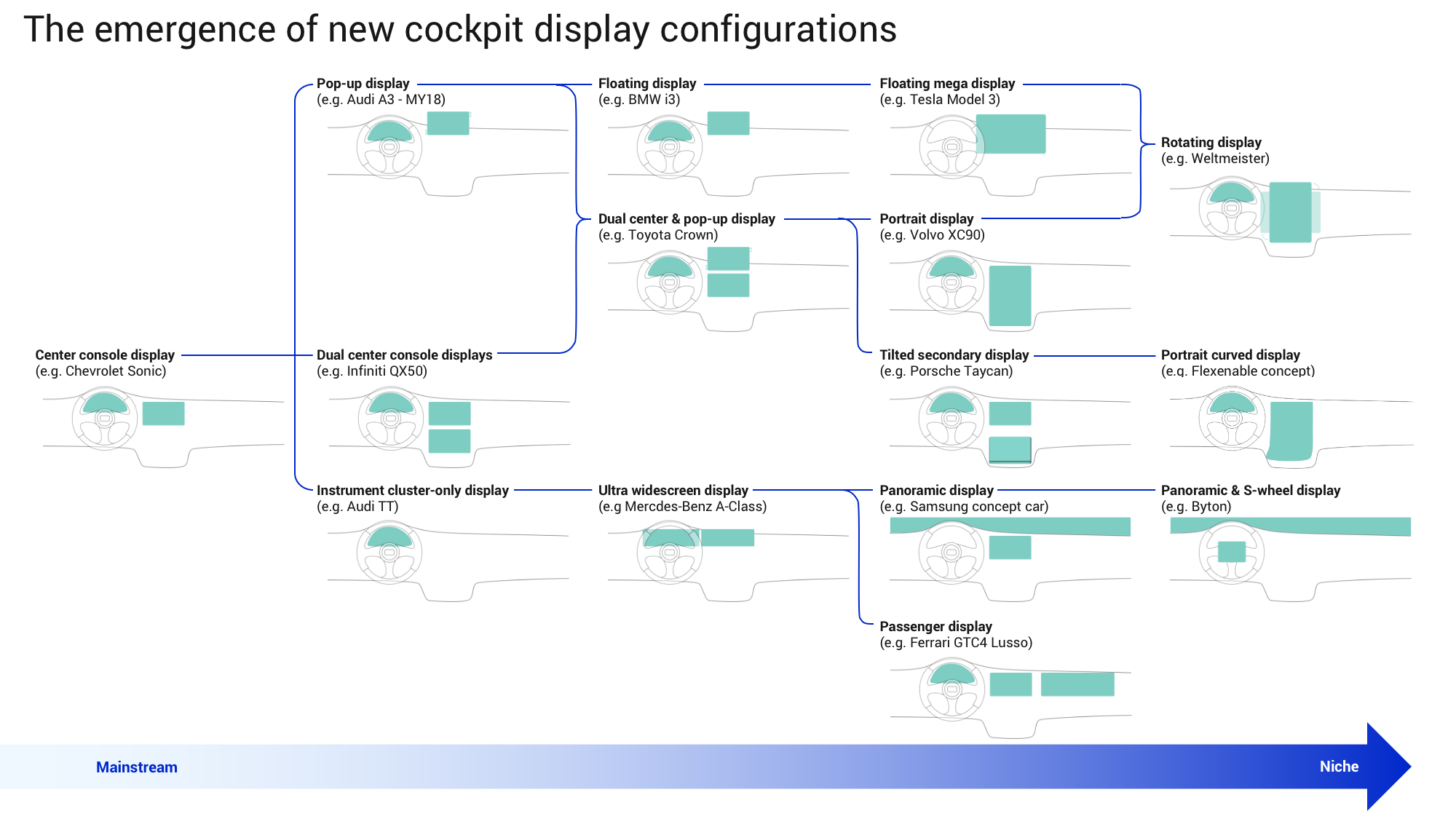

Trend 2: New display configurations

In addition to growing the size of displays, the industry has also been experimenting with an increasing array of configurations. From the early days of infotainment when the de-facto industry approach was to embed a single 6” display on the center console, there are now over a dozen high-level configurations that different car makers and suppliers have adopted.

All of the above configurations are available in the market today or will be launched during 2020. In choosing the right configuration for a given segment, car planners and designers are having to consider five requirements in parallel:

- Keeping the driver’s eyes on the road: the trend towards bringing displays closer to the driver’s line of sight for various configurations (e.g. BMW’s floating display) reflects a desire to minimize time spent not focussing on the road.

- Keeping the display within reach: in moving displays closer to the driver’s line of sight, however, HMI designers are also having to consider the ergonomics associated with a touchscreen that may also be out of reach.

- Distributing functions & content intuitively: As some car makers opt for multiple smaller displays instead of a single large one, it becomes even more important to carefully consider what functions and content are available where.

- Maintaining familiarity: The gradual decline of physical buttons and transition towards ‘soft’ buttons continues to be a difficult balance, as customers of different age groups set often conflicting demands on what needs to stay ‘physical’.

- Delivering a ‘wow’ experience: The ‘Tesla-effect’ is driving car makers to seek out unique and immersive display experiences that engage with both drivers and passengers.

More innovation on the way

The challenge for car makers is that the above requirements can sometimes be mutually exclusive – it can be difficult to develop display experiences that balance safety, intuitiveness and the desired ‘wow’ factor. This balance is likely to become harder as new technologies emerge. Below is a summary of the types of new experiences on the horizon for car cockpits:

Key conclusion: planning for a display-rich future

Displays are at the heart of the in-car customer experience and will continue to be so for the foreseeable future. Adding more and bigger displays seems an inevitable trend. However, adding hardware in itself may prove to be the easier part – building successful experiences using that hardware will require a great deal more:

- Multi-modal UX design: designing experiences that span seamlessly and intuitively across multiple displays and various other types of HMI modes (e.g. voice recognition, biometrics, etc).

- Driver distraction management: analysing driver distraction in real-time and putting it in the context of external factors (e.g. approaching vehicles) to dynamically adjust the ‘load’ associated with displays.

- Advanced usage analytics: collecting data from cars in order to assess friction points being faced by customers and evaluate under-usage of certain displays or functions.

- OTA updates: adopting an ‘always-improving’ culture that continually refreshes the software experiences with improvements and new features.

- New vehicle architectures: supporting all of the above by incorporating new domain-driven vehicle architectures that allow for seamless and scalable mutli-display management.

What’s SBD doing to help?

SBD recently published reports analyzing the future of OTA, driver monitoring and vehicle architectures, and later this year will also publish a report in the future of in-vehicle cockpits. As part of VehiclePlannerPlus we will also be evaluating how we can incorporate new types of display configurations within our database to make it easier to quantify and forecast penetration rates. If you would like to talk to us about these efforts, or any of the data included within this insight, please contact us.