Since 2010 the average number of options-per-model that car makers offer consumers has grown by 26%. In this article we analyze what is driving this growth, how OEM packaging strategies vary and what the longer-term outlook is for upselling features.

Choice is on the rise

Consumers have long been accustomed to choosing between different trims and options when purchasing their new cars. These are the two traditional mechanisms through which car makers have historically achieved their twin-commercial goals of ensuring a competitive entry-level MSRP while maximizing upsells to customers who want more.

Our data indicates that car makers have been steadily increasing the quantity of optional packages over the last decade at a faster rate than they have grown the range of models or trims. Some types of options have grown faster (particularly tyres, wheels and seating-related options), while others have actually shrunk as car makers have shifted to standard-fit strategies (particularly for infotainment and advanced safety features).

Overall, however, the trend is towards more – not less – choice. While in 2010 there was an average of 25 options-per-model, by 2019 this figure has now grown to 31. In the pick-up segment, this trend is even more pronounced, with the average number of options-per-model growing 69%, from 51 in 2010 to 83 in 2019 (incredibly, that figure reached 103 in 2018).

Car Buyer Choice Index

Although the industry as-a-whole is shifting towards offering more choice, individual car maker strategies vary significant. To highlight these differences, SBD has generated a Car Buyer Choice Index, which is derived from multiplying the average number of trims-per-model against the average number of options-per-model. When plotted against the brand-level sales volumes, the following insights emerge:

- Asian Car Makers typically offer limited choice but achieve similar or higher sales than many of their US counterparts, which have introduced a much greater level of choice (particularly across their pick-up ranges).

- Premium Car Makers are divided into two camps: high-choice brands (Mercedes-Benz, JLR , Porsche and Maserati) and low-choice brands (the rest).

The trend towards more choice is not necessarily being followed by all car makers. Brands like Mercedes-Benz, Land Rover and Jeep have consistently introduced more options and trims over the last five years, while other brands like Subaru, RAM and Audi have steadily gone in the other direction.

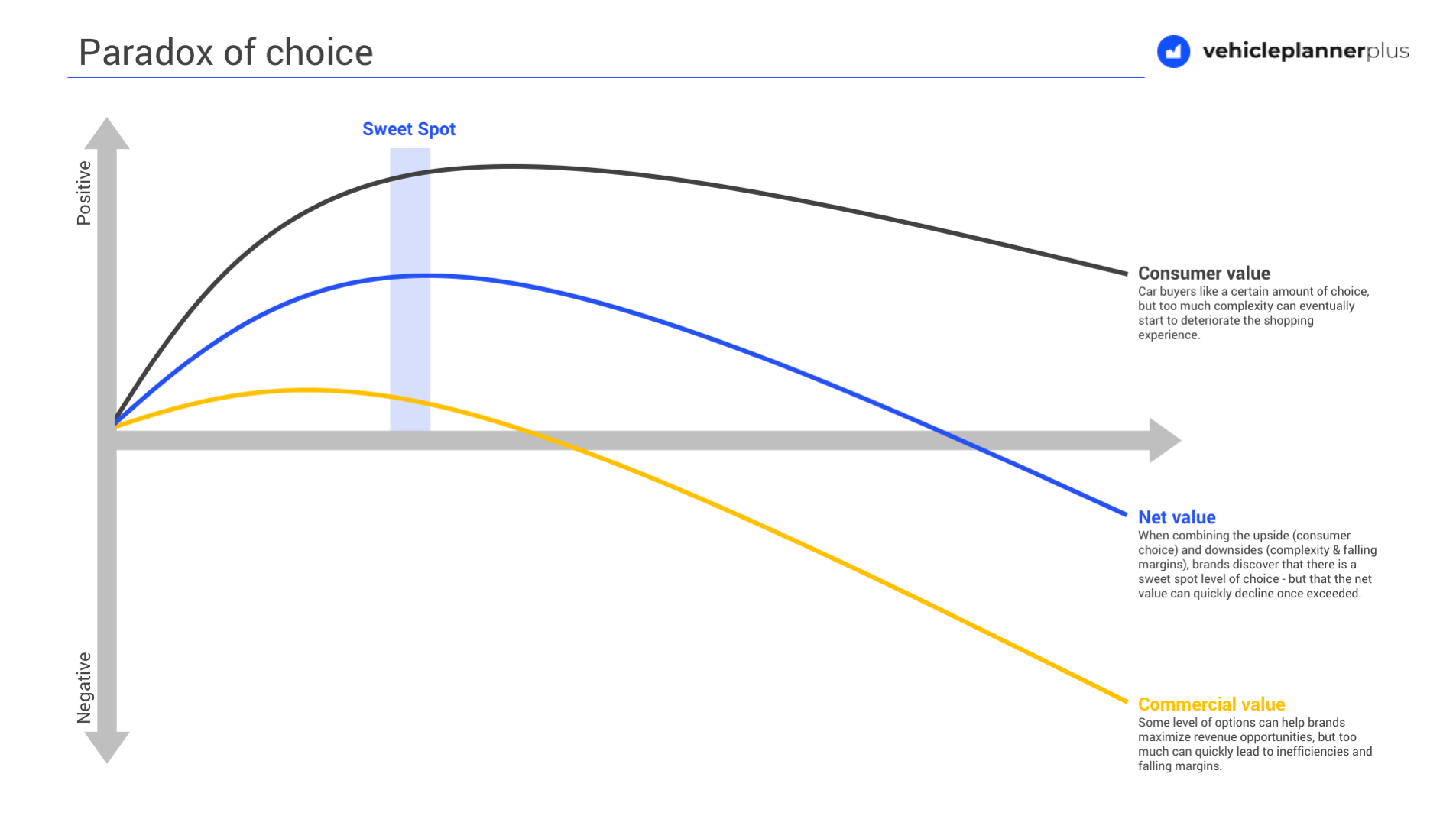

Is choice good or bad?

The short answer is – it depends. Providing more choice can be crucial to capturing a larger market share and maximizing revenues. If mismanaged, however, too much choice can eat into margins and potentially confuse buyers.

What lies ahead?

The industry as-a-whole often moves in cycles, with brands shifting between offering too much choice to not enough not choice. In addition to that ongoing cycle, SBD expects other trends to affect the way in which car makers adapt their options strategy:

- Value-led choice: The explosion of car technology has led to a steady deterioration in the car shopping experience, with consumers struggling to understand all the features and choices available to them. SBD expects brands to gradually reduce this complexity (even if they retain a high level of choice) by improving the user experience via digital catalogues and improved vehicle configurators.

- Software-as-an-option: Already today various features offered by car makers (e.g. Carplay and some camera-based ADAS features) are positioned as Options, but only require a software update to enable them. As car makers grow their reliance on software-based innovation to keep cars fresh, the purchase of options will shift away from a one-time decision at the dealer, to an ongoing consideration during the lifetime of the car.

- Feature-as-a-service: As a subsequent step, car makers like Audi are already looking for ways to deliver temporary access to vehicle features. For example, drivers may want a higher Horse Power for a fun weekend, or need massage seats for a long drive. Some of these examples may require car makers to pre-fit hardware in the expectation that they will be able to monetize that hardware during the lifetime of the car, thereby fundamentally changing the business model for options and features.

None of these changes will happen quickly, and they won’t be adopted across all car makers. However, we will continue to keep a close eye each quarter on changes in the Car Buyer Choice Index to see which brands are moving in this direction. In the meantime, please let us know if you have any questions on the analysis above.

Note. The above analysis excludes commercial vehicles.